After reviewing his expenses for the year, Garry determined his COGS is $650,000. COGS doesn’t include costs such as rent, utilities, payroll taxes, credit card readers, and advertising. You don’t include these indirect costs because they aren’t considered the materials or services you need to directly make your product. As an illustration, consider the corporation ABC Ltd., which manufactures items for rigid and flexible packaging.

What’s the Difference Between a High and Low Gross Profit Margin?

The more you can increase efficiency in your service-based business, the greater the gross profit you can expect. Increasing the cost of service, as long as it doesn’t alienate your customer base, will also help your bottom line and increase your gross profit. Anything you can do to increase efficiency or decrease costs directly improves your gross profit, meaning you can make more money without having to increase sales. Since gross profit is the difference between total sales and the cost of what you are selling, increasing gross profit directly impacts your bottom line. Both fixed costs and variable costs can have a large impact on gross profit. The more you can keep your fixed costs down and lower your variable costs, the greater gross profit you can expect.

Calculating Gross Profit

In this case, gross profit may indicate that a company is performing exceptionally well, but, when analyzing its profitability, it is important to note that there are also “below the line” costs. This makes net income more inclusive than gross profit and can provide insight into the effectiveness of overall financial management. The additional interest expenses for the debt incurred could lead to a decrease in net income despite efforts of the company for successful sales and production.

How to Calculate Gross Profit Example

The gross profit margin of a business does not necessarily represent its entire performance and financial standing. Since they don’t change much over time, these expenses might be referred to as fixed costs. It is the total amount of income your company generates from the sale of your products or services. It shows you clearly how much money you’re bringing in from your total sales. It does not include the costs of running your business, such as taxes, interest and depreciation.

What is the definition of gross profit ratio?

But it does not account for important financial considerations like administration and personnel costs, which are included in the operating margin calculation. Gross profit is the income after production costs have been subtracted from revenue and helps investors determine how much profit a company earns from the production and sale of its products. By comparison, net profit, or net income, is the profit left after all expenses and costs have been removed from revenue. It helps demonstrate a company’s overall profitability, which reflects the effectiveness of a company’s management. Consider the following quarterly income statement where a company has $100,000 in revenues and $75,000 in cost of goods sold.

What is Gross Profit Margin?

It is a significant figure that investors and financial institutions use to assess the company’s financial health. It makes it clearer how much money the business has on hand after paying all of its obligations and bills. If you know what to look for in a company’s financial reports, it’s very simple and straightforward to compute the gross profit percentage.

- Profit percentage is more than just a financial metric it’s a powerful tool that can drive strategic decision-making and business growth.

- The expenses that factor into gross profit are also more controllable than all the other expenses a company would incur in its overall operations.

- For instance, XYZ Law Office has revenues of $50,000 and has recorded rent expenses of $5,000.

- Sandra’s areas of focus include advising real estate agents, brokers, and investors.

- COGS doesn’t include costs such as rent, utilities, payroll taxes, credit card readers, and advertising.

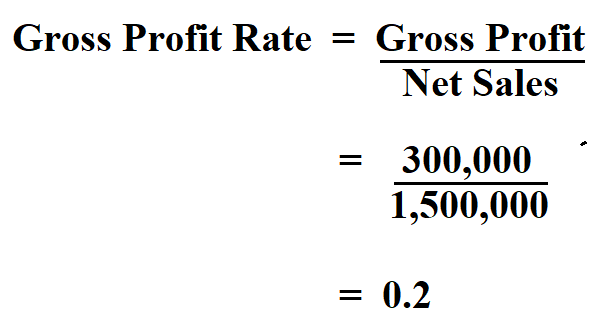

In essence, gross profit represents the money a company earns from its core operations, excluding expenses such as marketing, rent, and salaries. To determine gross profit, Garry would subtract COGS ($650,000) from his total revenue ($850,000). For gross profit, he would ignore the administrative costs and salary costs on his company’s commission definition formula and examples video and lesson transcript income statement. These are fixed costs and, as such, aren’t included in the gross profit formula. Gross profit is typically used to calculate a company’s gross profit margin, which shows your gross profit as a percentage of total sales. Unlike gross profit, the gross profit margin is a ratio, not an actual amount of money.

Under expenses, the calculation would not include selling, general, and administrative (SG&A) expenses. To arrive at the gross profit total, the $100,000 in revenues would subtract $75,000 in cost of goods sold to equal $25,000. A company’s gross profit will vary depending on whether it uses absorption or variable costing. Absorption costs include fixed and variable production costs in COGS, which can lower gross profit. Variable costing includes only variable costs in COGS, generally resulting in a higher gross profit since fixed costs are treated separately.